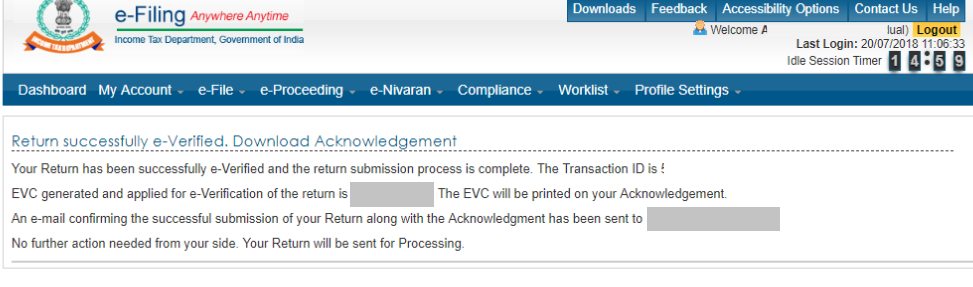

Once logged in, go to the 'My Profile page and click the 'Form 26 AS link under the Tax Credit Statement section.ĥ. You can also view Form 26 AS from the new income tax portal by logging into the income tax portal.Ĥ. Once you have successfully logged in, you can access Form 26AS by clicking on the 'View Tax Credit Statement(Form 26AS)' option available under the 'My Account' section.ģ. You can view Form 26 AS by logging into the TRACES portal.Ģ.

Part F- Domestic companies and mutual funds must deduct tax at source from distributed profits - get the information here.Part E - This part contains details of SFT (Statement of Financial Transaction) information, and any income from abroad, if applicable.Part D - This part contains information about refunds from the Income Tax Department and details of TDS default or non-deduction.Part C - contains details of High-Value Transactions (HVT) such as the purchase/ sale of immovable property, shares, bonds, etc., above ₹5 lakhs during the financial year.It shows all 26AS income tax payments made during a financial year. Part B - This part contains information related to Advance Tax, Self Assessment Tax, and Regular Assessment Tax payments made by the assessee.It shows details about the TDS/TCS deducted on income from salary, interest, etc., received by an individual. Part A - contains information related to the Tax Deducted at Source (TDS), and TCS Tax Collected at Source.

Form 26 AS consists of the following parts:

0 kommentar(er)

0 kommentar(er)